Turn capital into cash flow

Data-led off-plan picks, fast financing, and done-for-you operations – so your Dubai portfolio performs from day one

Trade License #1368010 Where investment becomes income

We underwrite off-plan projects for forward yields, secure financing in days, and hand over operate-ready assets-snagged, furnished, listed, and rented. You get clarity, speed, and income from day one.

Underwritten Off-Plan Opportunities

Curated projects with DealScore™ grading, conservative rents, and transparent costs

From capital to cash flow – in three steps

A clear, proven path to income-generating real estate

Blueprint

Budget, leverage, and yield targets analyzed with our Cashflow Blueprint™ tool

Tool Output:

- •2-3 property recommendations

- •Custom financing scenarios

- •Forward yield projections

- •Tax optimization strategies

Blueprint

Budget, leverage, and yield targets analyzed with our Cashflow Blueprint™ tool

Tool Output:

- •2-3 property recommendations

- •Custom financing scenarios

- •Forward yield projections

- •Tax optimization strategies

Acquire

A/B-grade DealScore™ properties with pre-approved financing in days

DealScore™ Includes:

- •A-F grading system

- •Rent comp analysis

- •Risk assessment

- •Financing pre-approval

Operate

Snag, furnish, list, and rent – get your first income payment in 30-45 days

Timeline:

- •Week 1: Snagging

- •Week 2: Furnishing

- •Week 3: Placement

- •Optimized monthly income

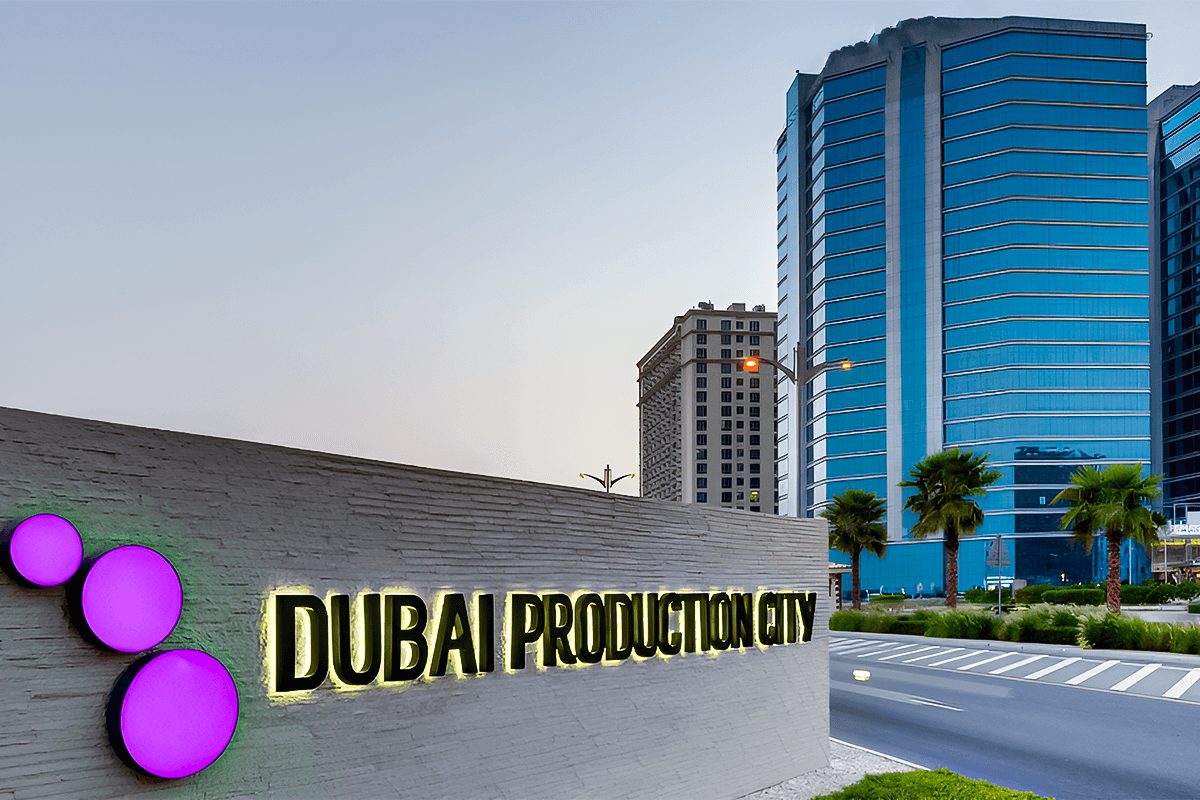

Location Index

Matching you with a community that feels like home and a lifestyle with limitless possibilities.

5 Days Free Tour

Exclusive Access. Limited Seats. Expert Guidance.

*Free tour - conditions apply

Your Investment Partner in Dubai

Your Investment Partner in Dubai

Since 2006, I've helped investors achieve exceptional returns through data-driven real estate strategies. Our platform combines cutting-edge tools with personal expertise to ensure your Dubai portfolio performs from day one.

RERA Licensed & Compliant

Full regulatory compliance and transparency

Personal Investment Portfolio

I invest in the same properties I recommend

End-to-End Service

From acquisition to rental income generation

What Our Clients Say

Choose your path

Whether you're ready to invest or just starting your research, we're here to guide you

Frequently Asked Questions

These are some of the most frequently asked questions about properties in Dubai.

Explore all FAQYes, foreigners can buy property in designated freehold areas in Dubai. These areas offer full ownership rights and long-term residency options.

Dubai Investment Blog

Explore our Dubai Property Blog

Al Marjan Island Projects (Ras Al Khaimah), the investor guide to what is actually happening, and what to watch next

Al Marjan Island in Ras Al Khaimah is in that rare “before and after” moment. You can feel it. New launches keep appearing, branded names are stacking up, and the conversation keeps circling back to one anchor, Wynn Al Marjan Island, scheduled to open Spring 2027.

Al Marjan Island Real Estate Price & Yield Analysis 2025-2026

Al Marjan Island is in a fast repricing phase going into 2026, largely because the Wynn resort pipeline is pulling attention, and supply is still uneven. “Average price per sq ft” depends on what you mean, valuation indexes show about AED 1,127 per sq ft in Q3 2025, while branded beachfront launches can list far higher.

Dubai Property Fees and Charges (UAE Guide 2026), DLD Transfer Fee, Oqood, Mortgage Costs, Service Charges

Dubai property fees typically land around 7% to 10% of the purchase price once you add everything up, especially on a normal resale deal. The big pieces are usually the 4% Dubai Land Department (DLD) fee, 2% agent commission plus 5% VAT, and trustee, registration, and admin fees that commonly sit around the AED 2,000 to AED 4,000 range plus VAT, depending on the property value.

List of Villa Communities in Dubai (2026), A Guide to Choosing the Right One

Dubai offers a wide range of premier villa communities catering to luxury, family friendly, and more affordable lifestyles, with popular options including Dubai Hills Estate, Arabian Ranches, Palm Jumeirah, DAMAC Hills, and Al Barari. And yes, the list is long enough to feel a bit overwhelming if you try to “research everything” in one sitting. I have tried, it never ends well.

How to Buy Off-Plan Below Market Price (15% to 35% Discounts), The Distressed Deal Playbook for 2026

Buying off-plan property significantly below market price requires targeting “distressed” deals, units where the original buyer needs to sell quickly, often to avoid defaulting on developer payments, or where a developer is clearing inventory. In 2026, these deals, particularly in markets like Dubai, can realistically show up at 15% to 35% below market value if you know where to look, and you can move fast.

Why My Dubai Property Is Not Selling and What You Can Actually Do About It

Dubai properties often struggle to sell for reasons that feel annoyingly simple in hindsight, overpricing, weak marketing, or a presentation that looks “fine” in real life but falls flat online. In a market where buyers can compare everything in two minutes, fine is rarely enough.